#SEC Charges Bittrex, Former CEO for Operating Unregistered Securities Exchange

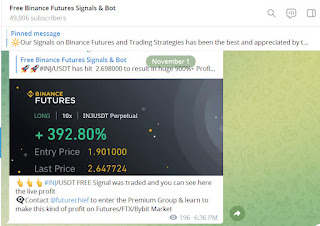

Visit - https://telegram.me/binancefuturesignal

Visit - https://binancefuturessignals.com/

Free Bitcoin Signals Mobile App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

Best Binance Futures, Bybit, Kucoin, WazirX, Coinswitch, CoinDCX, Bitmex, Bitfinex automated Crypto trading Bot - You don't need to sit in front of the charts and news channel for hours every day if you use an automated cryptocurrency trading bot. While you can use your time elsewhere, we take care of that for you. With our service, you may earn money while working or enjoying time with your family, and everything runs automatically with no human involvement.

Daily 4-5 high quality free Crypto signals for Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX, Bittrex & Bitmex on Telegram in 2023 with an around 80-90% accuracy. All signals are provided by our Experts Team with proper take profit and proper stop loss including leverage & Regular updates are also provided for Traders which ensures they enter and close trades at accurate time

The claim additionally names six tokens as protections, including Algorand.

The Protections and Trade Commission (SEC) documented charges against Bittrex Monday, claiming the Seattle-based trade neglected to consent to protections regulation by not enrolling with the monetary guard dog in a few regions.

The SEC's criminal objection charges the trade neglected to enroll as a representative vendor, trade, and clearing office, taking in something like $1.3 billion in illegal income somewhere in the range of 2017 and 2022.

The claim names Bittrex, Bittrex Worldwide, and Bittrex fellow benefactor and previous President Bill Shihara.

The requirement activity comes after Bittrex reported it was closing down before the end of last month, mentioning clients pull out their assets from the stage before the current month's over.

Bittrex has for a really long time opposed the administrative designs and dodged the exposure necessities that Congress and the SEC have throughout the span of many years developed for the insurance of the public protections markets and financial backers," the claim states.

The SEC's endeavor to pursue Bittrex addresses the most recent improvement in a line of implementation activities brought by U.S. controllers, focusing on a few cryptographic money trades up to this point this year, among different firms local to the computerized resources industry.

Kraken and Coinbase ended up unequivocally in SEC's sights over items connected with marking digital currencies, while the Product Prospects Exchanging Commission has pursued Binance for abusing a few subordinates exchanging rules.

"The present activity, once more, makes plain that the crypto markets experience the ill effects of an absence of administrative consistence, not an absence of administrative lucidity," SEC Executive Gary Gensler said in a public statement. "Today we're considering Bittrex responsible for its resistance."

The Protections and Trade Commission (SEC) documented charges against Bittrex Monday, claiming the Seattle-based trade neglected to follow protections regulation by not enlisting with the monetary guard dog in a few regions.

The SEC's criminal objection claims the trade neglected to enroll as a merchant seller, trade, and clearing organization, taking in something like $1.3 billion in illegal income somewhere in the range of 2017 and 2022.

The claim names Bittrex, Bittrex Worldwide, and Bittrex prime supporter and previous President Bill Shihara.

The implementation activity comes after Bittrex declared it was closing down toward the end of last month, mentioning clients pull out their assets from the stage before the current month's over.

Bittrex is a Seattle-based crypto trade. Picture: Shutterstock

Bittrex Appearances Potential Authorization Activity From The SEC: Report

One more day, another Wells notice. The SEC has supposedly told Bittrex of a potential requirement activity charging that the firm was going about as a trade, merchant vendor, and clearinghouse without enrolling with the controller. Back in Spring, SEC's implementation division purportedly educated Bittrex about the potential requirement activity — known as a Wells notice. Yet, this news came after the crypto firm had proactively begun to unwind its tasks in the US, David Maria the general advice o...

Algorand is by a long shot the biggest token named in the claim by market capitalization, positioned 42nd among all tokens at $1.6 billion, as per CoinGecko.

While the token was at that point bleeding cash, Algorand fell further after the claim's delivery, dropping 2.5% to $0.22 over the past da

"Bittrex has for quite a long time opposed the administrative designs and sidestepped the divulgence prerequisites that Congress and the SEC have throughout the span of many years developed for the insurance of the public protections markets and financial backers," the claim states.

The SEC's endeavor to pursue Bittrex addresses the most recent improvement in a line of requirement activities brought by U.S. controllers, focusing on a few cryptographic money trades up to this point this year, among different firms local to the computerized resources industry.

Kraken and Coinbase wound up unequivocally in SEC's sights over items connected with marking digital currencies, while the Product Fates Exchanging Commission has pursued Binance for abusing a few subsidiaries exchanging rules.

"The present activity, once more, makes plain that the crypto markets experience the ill effects of an absence of administrative consistence, not an absence of administrative clearness," SEC Director Gary Gensler said in a public statement. "Today we're considering Bittrex responsible for its rebelliousness."

Tokens on Bittrex at the center of attention

The claim takes note of that since the trade's origin, it presented north of 300 computerized resources for financial backers.

However, what's more, "a significant number of the tradeable crypto resources on the Bittrex Stage have qualities" that purportedly look like protections, the claim explicitly names six tokens as models on Bittrex that incorporate OMG Organization (OMG), Run (Run), Algorand (ALGO), Stone monument (TKN), Naga (NGC), and Land Convention (IHT).

Algorand is by a wide margin the biggest token named in the claim by market capitalization, positioned 42nd among all tokens at $1.6 billion, as per CoinGecko.

While the token was at that point bleeding cash, Algorand fell further after the claim's delivery, dropping 2.5% to $0.22 throughout the last day.

The SEC claim blames Bittrex for neglecting to enlist as well as placing benefits over financial backer securities in posting specific tokens, very much aware of what to keep away from regarding possible SEC examination.

During his residency as President of Bittrex, Shihara was at the very front of a mission inside the organization to tidy up "hazardous explanations," where the trade guided the guarantors of computerized resources for scour public proclamations of language that would cause a commotion at the SEC, the claim charges.

Notwithstanding, despite the fact that it started eliminating certain crypto resources from its foundation to stay away from SEC examination in April 2019, the trade purportedly got back exactly an endeavor to "remain important," including Run and OMG.

Comments

Post a Comment