#Visa Says It's Not Slowing Down Plans for Crypto Products

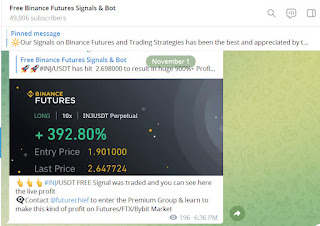

Binance Future Signals - https://binancefuturessignals.com/

Binance Future Signals - https://telegram.me/binancefuturesignal

Free Bitcoin Signals Mobile App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

We have more than 50000 active members in our Telegram group. We make daily profit through great trading ideas and analysis. Verify all our Trade Statements and be a part of the every growing Crypto trading Signals channel on Telegram in 2023

Free Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX & Bitmex Crypto signals on Telegram with an around 80-90% accuracy. All signals are provided by our Experts Team with proper take profit and proper stop loss including leverage

We also introduce you to the only Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX BOT in the crypto world. Our Bot is highly efficient and which execute trades in our live master accounts using our capital. Then through cutting edge technology, our Bot copies all your Signals via Cornix Bot on your Account. It is all automatic without any manual intervention

The payments giant still wants to grow its digital asset department, according to the company's head of crypto.

Payments company Visa has said it is not slowing down with its cryptocurrency plans—despite news reports hinting otherwise amid a brutal bear market.

The U.S. company’s Head of Crypto Cuy Sheffield said in a series of tweets Tuesday that a Reuters story claiming both Visa and Mastercard were slowing down their crypto push was “inaccurate” when it comes to Visa.

He added that “despite the challenges and uncertainty in the crypto ecosystem,” Visa believes that “fiat backed digital currencies running on public blockchains have the potential to play an important role in the payments ecosystem.”

Visa has been working with the crypto space for sometime but things have slowed down as of late: In November, it ended its global credit card agreements with failed crypto exchange FTX.

The company had announced plans to roll out cards to 40 new countries as part of a “long-term global partnership”—but pulled the plug when the crypto company went bust.

FTX went bankrupt in a highly publicized crash and is now being investigated for criminal mismanagement. Prosecutors allege the firm commingled customer funds; its ex-boss Sam Bankman-Fried is now facing 12 criminal charges.

Visa also filed new trademark applications back in October, which hinted at potential plans for a crypto wallet and a metaverse product. Crypto wallets, such as MetaMask or Phantom, are used to store digital assets like Bitcoin or Ethereum and make payments. Meanwhile, the metaverse refers to a shared virtual world online, and has become a focal point for various crypto and fintech companies.

The collapse of the mega exchange FTX and the contagion that has followed is forcing U.S. lawmakers and regulators to come up with new ideas on how to regulate the space.

A Visa spokesperson told Decrypt: “Recent high-profile failures in the crypto sector are an important reminder that we have a long way to go before crypto becomes a part of mainstream payments and financial services.”

The spokesperson added that Visa remains “focused on growing our core competencies in Web3 infrastructure layers and evaluating the blockchain protocols driving crypto development.”

Comments

Post a Comment