#SEC Chair Under Fire by Congress: “Is Ether a Commodity or a Security?”

Visit - https://telegram.me/binancefuturesignal

Visit - https://binancefuturessignals.com/

Free Bitcoin Signals Mobile App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

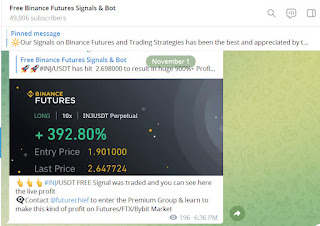

Best Automated Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX auto trading BOT in the crypto world. Our Bot is highly efficient and which execute trades in our live master accounts using our capital. Then through cutting edge technology, our Bot copies all your Signals via Cornix Bot on your Account. It is all automatic without any manual intervention copies the trade on your account

Free Crypto signals for Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX, Bittrex & Bitmex on Telegram in 2023 with an around 80-90% accuracy. All signals are provided by our Experts Team with proper take profit and proper stop loss including leverage & Regular updates are also provided for Traders which ensures they enter and close trades at accurate time

Gary Gensler was addressed by the House Monetary Administrations Council on his achievements - and disappointments - in directing crypto.

Protections and Trade Commission (SEC) Executive Gary Gensler affirmed before the House Monetary Administrations Advisory group on Tuesday with respect to the office's authorization activities against the crypto business throughout the course of recent months.

The seat was squeezed for replies on how precisely he separates between crypto protections and crypto wares, and late hardships for crypto firms to get to monetary administrations. Where could the Clearness be?

In his initial explanation, council seat Patrick McHenry noticed that Gensler and the current year's trade bonus had brought "almost 50 separate implementation activities against computerized resource firms." The office intends to grow that requirement with a mentioned $78 million in subsidizing.

"Simultaneously, you have would not give clearness on whether computerized resources presented as a component of a venture contract are dependent upon protections regulations, and all the more critically, how these organizations ought to consent to those regulations," he proceeded.

In past explanations and meetings, Gensler has guaranteed that by far most of crypto resources are protections, just unequivocally naming Bitcoin as an item. Past the biggest crypto, he's wouldn't name names - in any event, trying not to offer an immediate response about Ethereum's grouping.

A similar occurred during Tuesday's hearing. When asked by McHenry whether Ether was an item or a security, Gensler only expressed that "the lucidity is there, the law is clear and unequivocal."

Gensler regularly refers to the Howey Test when requested to decide if a computerized resource is a security or not. Under the test, a monetary resource gave to fund-raise with an assumption for benefit in view of the endeavors of others qualifies as an "speculation contract."

Guideline by Authorization

On implementation activities, Minnesota Rep Tom Emmer asked a progression of fast fire inquiries connected with the undeniably threatening banking and administrative climate crypto firms are looking in the US. As Gensler wondered whether or not to offer short and direct responses, Emmer stated that the SEC aided assume a part in making it more hard for crypto firms to work in the country.

"Your administrative style needs adaptability and subtlety, and thus, you've been a clumsy cop on the beat," said Emmer, "never really safeguarding ordinary Americans, and driving American firms under the control of the CCP."

Emmer additionally scrutinized Gensler for permitting the extravagant Land and FTX breakdown to happen on his watch. The representative proposed last year that FTX was given "exceptional treatment" by the SEC that different firms weren't aware of.

Comments

Post a Comment