#Ethereum Price Prediction as Shanghai Upgrade Approaches – Will Ethereum Dump After the News?

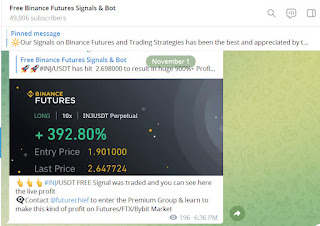

Visit - https://telegram.me/binancefuturesignal

Visit - https://binancefuturessignals.com/

Free Bitcoin Signals Mobile App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

Free Crypto signals Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX & Bitmex on Telegram in 2023 with an around 80-90% accuracy. All signals are provided by our Experts Team with proper take profit and proper stop loss including leverage & Regular updates are also provided for Traders which ensures they enter and close trades at accurate time

We also offer Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX auto trading BOT in the crypto world. Our Bot is highly efficient and which execute trades in our live master accounts using our capital. Then through cutting edge technology, our Bot copies all your Signals via Cornix Bot on your Account. It is all automatic without any manual intervention

Ether (ETH), the cryptocurrency that powers smart-contract-enabled Ethereum blockchain, hit its highest levels since last August on Tuesday close to $1,900, despite the network’s upcoming Shanghai upgrade that some have warned might trigger a price drop amid a “sell-the-news” event.

As a result, price predictions generally remain upbeat.

On the 12th of April, the Ethereum network will undergo a series of upgrades that will, first and foremost, enable the withdrawal of staked Ether tokens from the staking smart contract.

While analysts view the development as a long-term positive for the network – it is assumed that more flexible staking withdrawals will eventually attract many more ETH owners into staking their tokens – some have warned that there could be short-term price pressures, as investors sell ETH tokens that have been stuck in staking contracts for a long time.

ETH staking has been active since late-2020 on Ethereum’s beacon chain, prior to the Ethereum blockchain’s merge to proof-of-stake last September.

Others have warned that in wake of ETH’s stunning more than 55% gains since the turn of the year, a successful Shanghai upgrade might trigger profit-taking that could cause ETH price downside in the short term.

Price Prediction – Will Ether (ETH) Dump After the Upgrade?

Despite these concerns about a potential dump, Ether’s technical outlook is looking good in the short term.

In recent weeks, the cryptocurrency has continually found good support at its 21-Day Moving Average.

All of its major moving averages are all pointing higher in consecutive order, another bullish sign.

A sustained push above the $1,850 area, which had previously been offering resistance, should open the door to a near-term test of the August 2022 highs above $2,000, assuming no post-Shanghai upgrade price dump.

In the longer term, technicals are also positive. ETH’s 14-Day Relative Strength Index (RSI) is not yet in overbought territory, suggesting a reduced risk of near-term profit-taking.

ETH also saw a strong bounce from its 200DMA last month, a strong medium-term bullish indicator.

The “golden cross” (when the 50-Day Moving Average crosses above the 200-Day Moving Average) in early February is another good sign for ETH’s medium-term technical outlook.

Recent news of an attack by a malicious Ethereum validator, while spreading concern about network security amongst the hard-core crypto community, hasn’t had any effect on the price.

That could be because network upgrade optimism and macro tailwinds, such as expectations that the Fed will be cutting interest rates later this year to stave off a bank crisis and recession, remains in the forefront.

In the near term, bulls will likely continue buying any Ether price dips.

A post-Shanghai upgrade sell-the-news driven dip back to the resistance-turned-support $1,700 area, which also roughly coincides with ETH’s 50-Day Moving Average, could present a nice buying opportunity.

Ether (ETH) Alternatives to Consider

While Ether’s medium-term outlook is robust and a near-term move back above $2,000 is likely on the cards, investors should always be looking to diversify their crypto holdings.

One high-risk-high-reward investment strategy that some investors might want to consider is getting involved in crypto presales.

This is where investors buy the tokens of up-start crypto projects to help fund their development.

These tokens are nearly always sold very cheap and there is a long history of presales delivering huge exponential gains to early investors.

Of course, there is always a chance that the project’s founders don’t deliver on the project’s promises, and the presale tokens never take off in price (hence why they are sold so cheap).

But many of these projects have fantastic teams behind them and a great vision to deliver a revolutionary crypto application/platform.

If an investor can identify such projects, the risk/reward of their presale investment is very good.

The team at Cryptonews.com spends a lot of time combing through presale projects to help investors out.

Here is a list of 15 of what the project deems as the best crypto presales of 2023.

Comments

Post a Comment