#Ethereum price falls below $1,900 as Shanghai upgrade approaches

Visit - https://telegram.me/binancefuturesignal

Visit - https://binancefuturessignals.com/

Free Bitcoin Signals Mobile App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

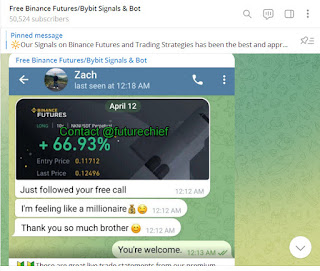

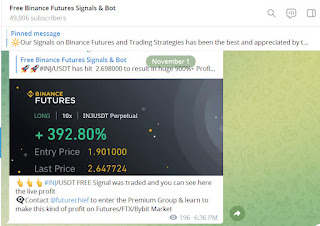

Binance Futures, Bybit, Kucoin, WazirX, Coinswitch, CoinDCX, Bitmex, Bitfinex auto trading Bot - You don’t need to spend hours in front of the charts and news channel everyday. We do that for you while you can spend that time elsewhere. You can have our service and make money while you are on a job or spending time with your family. It is all automatic without any manual intervention

We also provide high quality free Crypto signals Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX & Bitmex on Telegram in 2023 with an around 80-90% accuracy. All signals are provided by our Experts Team with proper take profit and proper stop loss including leverage & Regular updates are also provided for Traders which ensures they enter and close trades at accurate time

Ethereum is down very slightly pending an event that will gradually unlock staked ETH.

The price of Ethereum (ETH) fell below $1,900 on April 11, representing a minor loss during the hours leading up to the blockchain’s anticipated Shanghai upgrade.

ETH market value falls below $1,900

The market value of ETH fell from $1,921 to as low as $1,888 over a short period. That change was seen during the hour leading up to 8:30 p.m. UTC on April 11.

As of 1:30 a.m. UTC on April 12, the asset is still valued at $1,895. The change in value represents a loss of just 1.0% over the past 24 hours.

The small fluctuation is made somewhat more notable by the fact that Bitcoin is up 2.0% over the same period of time. Meanwhile, the crypto market in its entirety is up 1.0% over the past 24 hours and certain other top 10 tokens are in the green.

Shanghai has been received positively

Public sentiment around Shanghai appears to be largely positive. The feature will allow validators to withdraw staked ETH for the first time.

Currently, 18 million ETH is staked, according to the Ethereum Foundation. That amount is worth about $34 billion and is a significant portion of Ethereum’s $227 billion market cap. If a significant amount of ETH enters circulation, the upgrade could affect prices.

However, it is not clear that most of that amount will be unstaked in the long term, and it is impossible for a large amount to be unstaked immediately. In order to prevent major effects on the market, about 1,800 validators will be able to unstake ETH each per day.

Despite these assurances, it is possible that uncertainty around the event has caused some investors to sell their ETH, leading to the mild price loss seen today.

Shanghai will also introduce other features unrelated to stake unlocking. Notably, it aims to reduce the gas fees that Ethereum developers pay and make other improvements.

Comments

Post a Comment