##What the US Crypto Crackdown Means for the Rest of the World

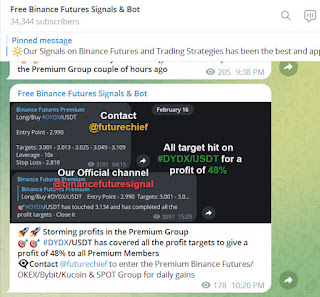

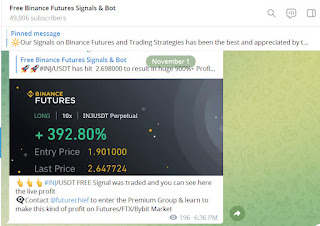

Binance Future Signals - https://binancefuturessignals.com/

Binance Future Signals - https://telegram.me/binancefuturesignal

Free Bitcoin Signals Mobile App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

Free Crypto signals on Telegram for Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX & Bitmex with an around 80-90% accuracy. All signals are provided by our Experts Team with proper take profit and proper stop loss including leverage & Signals are informed to Elite Members very early in advance thus any trader from any part of the World can easily take position

Binance Futures, Bybit, Kucoin, WazirX, Coinswitch, CoinDCX, Bitmex, Bitfinex, auto trading Bot which is highly efficient and makes accurate trades. It makes trading very easy for all our Traders as it allows you set your own amount for each coin. Here you don’t need to spend hours in front of the charts and news channel everyday. This BOT copied all your premium Signals via cornix BOT in your Account & make consistent profit. It is all automatic without any manual intervention

In Brief

The U.S. has maintained a strict stance against crypto.

Industry stakeholders believe that U.S. is driving away Web3 businesses.

Brian Armstrong, the CEO of Coinbase has condemned the regulations.

As U.S. regulators set their sights on crypto companies, does this mean that other countries are in with a chance at becoming a crypto hub?

The United States Securities and Exchange Commission (SEC) is hunting down Web3 companies with its strict policies. Recently it fined Kraken $30 million and ordered the closure of its staking reward facilities.

Then, the SEC warned Paxos of possible legal action for violating securities law. Regulators also oppose listing Bitcoin spot Exchange Traded Funds (ETFs.) But it is the SEC’s lawsuit against Ripple Labs that is the most notable.

Countries Race to Become Crypto Hub

While the U.S. has adopted a stricter stance against crypto companies, other countries are maintaining a more accommodating stance. The Financial Secretary of Hong Kong, Paul Chan, announced in January that they are working to make the country a crypto hub. After the announcement, the Singapore-based DBS bank, and Huobi exchange unveiled their plans to expand business into the territory.

The United Kingdom is steadily moving towards full-fledged crypto regulation. It has entered the second phase of its path toward regulation, with the government seeking feedback from industry stakeholders. The prime minister of the U.K., Rishi Sunak, envisions making the country a crypto hub.

This month, Dubai released rulebooks to provide specific frameworks to Web3 firms. The country, already a favorite destination for crypto-related events and conferences, aims to position itself as an international crypto hub.

In Asia, South Korea is utilizing blockchain technology to its fullest potential. Busan, one of the fastest aging cities in South Korea, wants to become crypto-friendly to attract immigration from younger people. The city has also entered an agreement with Binance to establish a public crypto exchange. South Korea is also building public metaverses in Seoul and Seongnam. Recently, the Asian country also allowed the issuance of security tokens for business ownership.

El Salvador and the Central African Republic have made Bitcoin legal tender. El Salvador has committed to mass Bitcoin adoption, intending to educate 250,000 students about Bitcoin in 2023. The Government has also launched a special Bitcoin Office to manage all cryptocurrency-related projects.

Investors and Companies Moving Away From the U.S.

With the U.S. shunning greater crypto adoption and other countries supporting it, firms are slowly moving away from the nation. Sheila Warren, the Chief Executive Officer (CEO) of the Crypto Council for Innovation, told Bloomberg, “By favoring enforcement instead of passing rules in line with other regions, the U.S. has left both regulators and companies grappling with what is essentially a guessing game as to what might come next.”

Zhuling Chen, the CEO of RockX, says, “Given the increasing level of regulatory scrutiny and enforcement we have seen, several US crypto investors are growing a bit nervous. Whoever has interest and wants to stay in crypto will choose friendlier countries, where the rules are clear.”

And Jeff Dorman, the Chief Investment Officer at Arca, says new Web3 firms are “not even bothering with the U.S

.”

Comments

Post a Comment