##Crypto Fund Outflows Hit All-Time High Last Week, $255M in Bitcoin, Ethereum

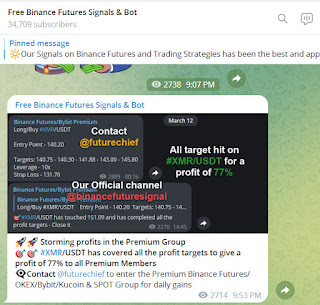

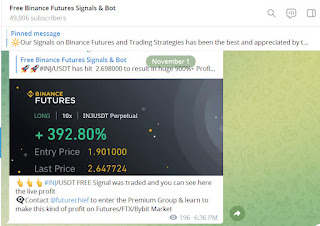

Binance Future Signals - https://binancefuturessignals.com/

Binance Future Signals - https://telegram.me/binancefuturesignal

Free Bitcoin Signals Mobile App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

#Best Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX & Bitmex Crypto signals on Telegram in 2023 with an around 80-90% accuracy. All signals are provided by our Experts Team with proper take profit and proper stop loss including leverage & Regular updates are also provided for Traders which ensures they enter and close trades at accurate time

We also provide Binance Futures, Bybit, Kucoin, WazirX, Coinswitch, CoinDCX, Bitmex, Bitfinex auto trading Bot - You don’t need to spend hours in front of the charts and news channel everyday. We do that for you while you can spend that time elsewhere. You can have our service and make money while you are on a job or spending time with your family

The cumulative weekly outflows for crypto funds last week hit their highest since CoinShares began tracking the sector.

Investors pulled a net total of $255 million out of exchange-traded crypto funds last week, the largest weekly outflow CoinShares has ever recorded, according to a report on Monday.

Assets under management, or AUM, fell by 10% over the past week to $26 billion, undoing the progress made in crypto-based funds since the start of the year. The drawdown represents 1% of total assets invested in crypto funds, according to CoinShares.

CoinShares tracks the flow of money in and out of exchange-traded products, mutual funds, and over-the-counter (OTC) trusts that track crypto assets like Bitcoin, Ethereum, and altcoins.

Bitcoin funds were hit especially hard, accounting for $244 million of the money flowing out of crypto funds, according to CoinShares. Ethereum funds lost $11 million during the week and outflows from altcoin funds, like Litecoin and Tron, accounted for less than $1 million, according to the report.

Weekly inflows into Solana, XRP, Polygon, and multi-asset funds totaled just $3 million.

CoinShares head of research James Butterfill wrote that while the weekly total outflow was the highest it’s ever been, it’s not the highest when expressed as a percentage of total assets invested in crypto funds.

Back in May 2019, a $51 million weekly outflow represented about 2% of all assets invested in crypto funds at the time.

“It highlights just how much total AUM has risen since May 2019— 816%,” he wrote in the report.

Last week was brutal for the banking industry, especially institutions that serve the technology sector and crypto industry.

After weeks of speculation that it wouldn’t survive the blow it was dealt when former client FTX filed for bankruptcy, crypto-friendly Silvergate Bank announced that it was winding down operations on Wednesday.

Comments

Post a Comment