#Hong Kong Mulls Reopening Crypto Trading for Retail Investors

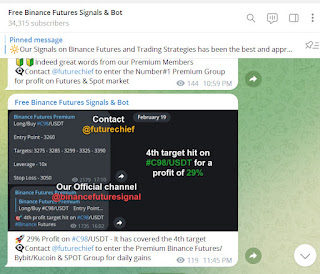

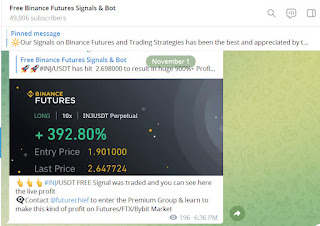

Binance Future Signals - https://binancefuturessignals.com/

Binance Future Signals - https://telegram.me/binancefuturesignal

Free Bitcoin Signals Mobile App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

Free Binance Futures Signals & Bot team that sends live buy and sell signals With TP/SL points. We offer Crypto signals for Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX & Bitmex with an around 80-90% accuracy. We provide high end tools and high quality Signals get & All our Signals are posted after detailed analysis - Signals are informed to Elite Members very early in advance thus any trader from any part of the World can easily take position

We also provide Binance Futures, Bybit, Kucoin, WazirX, Coinswitch, CoinDCX, Bitmex, Bitfinex auto trading Bot - You don’t need to spend hours in front of the charts and news channel everyday. We do that for you while you can spend that time elsewhere. You can have our service and make money while you are on a job or spending time with your family

A new consultation paper from Hong Kong's financial regulator outlined several new criteria for letting retail investors back into crypto.

Hong Kong looks ready to invite retail traders back to the crypto casino.

In a new consultation paper, the Securities and Futures Commission of Hong Kong (SFC) proposed "to allow all types of investors, including retail investors, to access trading services provided by licensed VA [virtual asset] trading platform operators."

The proposal recommends that several conditions be met before crypto trading for retail investors is reopened, however—including knowledge and risk assessments, as well as potentially setting limits to how much exposure traders are allowed.

The SFC identified criteria for which cryptocurrencies would be available for trading, too. Trading platforms would be responsible for vetting the team behind a token, as well as marketing materials, legal risks, and to establish "how resistant it [the token's network] to common attacks" such as a 51% attack.

After that, though, the token pool appears relatively shallow, with the Commission proposing that only "large-cap virtual assets" be eligible for listing.

This is defined by the SFC as tokens "which are included in at least two 'acceptable indices' issued by at least two independent index providers."

These and other aspects of the newly-proposed crypto regime in Hong Kong are still open for discussion. Interested parties looking to contribute to the process have until March 31, 2023. The regime is expected to come into effect on June 1, 2023.

The Commission said that the "virtual asset landscape has changed significantly" since it introduced the current regulatory framework back in 2018. This framework only allowed trading platforms to offer their services to professional traders and institutional clients.

Over time, this approach has loosened some. Last year, for example, the SFC allowed retail traders to begin trading derivative products and crypto exchange-traded funds (ETFs).

The latter types of products allow investors to gain exposure to the underlying cryptocurrency without needing to self-custody the asset. HKEX was one of the first stock exchanges in Hong Kong to launch a Bitcoin and Ethereum ETF product last December, each tracking futures traded on the Chicago Mercantile Exchange

Comments

Post a Comment