##Bitcoin Included? Saudi Arabia To Accept Non-Dollar Currencies For Oil

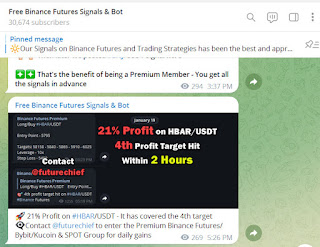

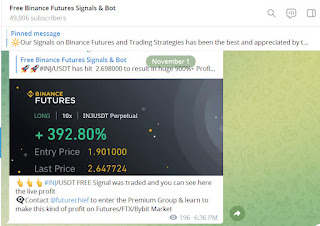

Binance Future Signals - https://binancefuturessignals.com/

Binance Future Signals - https://telegram.me/binancefuturesignal

Free Bitcoin Signals Mobile App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

We have more than 50000 active members in our Telegram group. We make daily profit through great trading ideas and analysis. Verify all our Trade Statements and be a part of the every growing Crypto trading Signals Community on Telegram in 2023

#FREE Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX, Bitmex trading Signals Community on Telegram whatsapp group link & reddit in 2023 providing Crypto signals with an around 80-90% accuracy. All signals are provided by our Experts Team with proper take profit and proper stop loss including leverage for making daily profit in your account & Signals are informed to Elite Members very early in advance thus any trader from any part of the World can easily take position

We also provide Binance Futures, Bybit, Kucoin, Bitfinex, WazirX, Coinswitch, CoinDCX, Bitmex, Binance BOT - You don’t need to spend hours in front of the charts and news channel everyday. We do that for you while you can spend that time elsewhere. You can have our service and make money while you are on a job or spending time with your family.

Per a report, the biggest oil exporter in the world, Saudi Arabia, might take a hit to the U.S. dollar (USD) supremacy for the benefit of Bitcoin and other global currencies. During the World Economic Forum (WEF) in Davos, the country’s minister of finance, Mohammed Al-Jadaan, hinted at the possibility of accepting non-dollar currencies to trade oil.

Since the 1970s, Saudi Arabia has agreed to price its oil in the U.S. dollar, giving this currency and its country an advantage over the world. This system is known as the “Petrodollar,” and it’s part of the machinery that supports the dollar’s global reserve currency status.

A New World Order, What’s Bitcoin’s Role In It?

Al-Jadaan claims Saudi Arabia is open to revisiting this agreement as it strengthens its ties with the world’s largest oil importer and U.S. rival, China. During the WEF, the government official stated the following, opening a Pandora’s Box that can affect the market for years to come:

There are no issues with discussing how we settle our trade arrangements, whether it is in the US dollar, whether it is the euro, whether it is the Saudi riyal. I don’t think we are waving away or ruling out any discussion that will help improve the trade around the world.

According to the report, China is moving in to speed up a shift in the U.S. dollar global currency status. The Asian giant is offering its partners access to the Shanghai Petroleum and Natural Gas Exchange, a platform that operates with the Chinese Yuan.

In 2022, the Petrodollar system was questioned by Arthur Hayes, founder of the crypto exchange BitMEX. Per a report from our sister website, NewsBTC, Hayes believes this system was jeopardized by the sanctions imposed by the International Community on Russia. The

BitMEX Founder said in 2022:

In addition, the Petrodollar system is jeopardized by China and its allies trying to gain trade influence and break the multidecade system. In this new scenario, countries will seek a neutral currency, such as Gold and Bitcoin, as the dollar losses strength. Hayes:

A new neutral reserve asset, which I believe will be gold, will be used to facilitate global trade in energy and foodstuffs. From a philosophical standpoint, central banks and sovereigns appreciate the value of gold, but not that of Bitcoin (…). Bitcoin is less than two decades old. But don’t worry: as gold succeeds so will Bitcoin.

Now add in the news that Saudi Arabia is considering accepting Yuan instead of Dollars for Chinese oil and you have an accelerator for more economic problems and market uncertainty.

Comments

Post a Comment