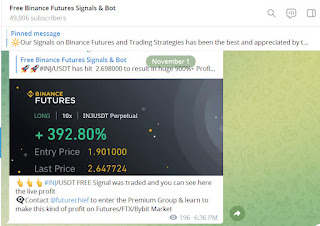

Binance Future Signals - https://binancefuturessignals.com/

Binance Future Bot - https://telegram.me/binancefuturesignal

Free Bitcoin Signals Mobile App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

We have more than 50000 active members in our Telegram channel. We make daily profit through great trading ideas and analysis. Verify all our Trade Statements and be a part of the every growing Crypto trading Signals Community on Telegram in 2023

FREE Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX, Bitmex trading signals Group on telegram in 2023 providing Crypto signals with an around 80-90% accuracy. All signals are provided by our Experts Team with proper take profit and proper stop loss including leverage for making daily profit in your account & Signals are informed to Elite Members very early in advance thus any trader from any part of the World can easily take position

##Binance Futures, Bybit, Kucoin, WazirX, Coinswitch, CoinDCX, Bitmex, Bitfinex, auto trading BOT which execute trades in our live master accounts using our capital. Then through cutting edge technology, our Bot copies all your Signals via Cornix Bot on your Account. It is all automatic without any manual intervention

Bitcoin’s 30-Day Correlation With Nasdaq Plunges To Just 0.29

According to the latest weekly report from Arcane Research, movements in US markets are becoming less relevant to BTC. The “30-day correlation” is an indicator that measures how closely Bitcoin and another given asset performed during the past month.

When the value of this metric is positive, it means BTC has been responding to changes in the price of the other asset by moving in the same direction. On the other hand, negative values imply BTC has been displaying opposite price action relative to the asset.

Naturally, the correlation is precisely equal to zero, suggesting the prices of the two assets aren’t tied in any shape.

The report notes a few reasons behind the two assets being this correlated. First, institutional investors, who treat BTC as a risk asset, saw a rising presence in the market during this period. These investors are sensitive to macro movements and thus contribute to Bitcoin’s high correlation with the stock market.

Second, growth companies like Tesla held large amounts of Bitcoin exposure in the past year. This presence of public companies also naturally led to BTC being tied with Nasdaq.

The third factor was the selling being done by miners. This cohort was being pressured by higher interest rate costs (as they took on large debts to expand their operations) and the rising energy costs, which left them with no choice but to sell off their BTC reserves.

The fourth and last reason was the short-sighted decisions made by crypto companies, who prioritized growth over healthy financials in the low-interest rate regime of the past. 2022’s prolonged bear market has left most of these firms with huge losses, forcing some of them to go bankrupt.

Most recently, however, the Bitcoin correlation with Nasdaq has decreased significantly, as the metric’s value is just 0.29, the lowest level observed since December 2021, more than a year ago.

“Compared to 2022, public companies hold far less BTC, miners have less BTC to sell, and several institutional players have left the market,” explains Arcane Research. “All of these factors are in favor of softening correlations onwards.”

Comments

Post a Comment