#How to invest in Litecoin: is it a good investment?

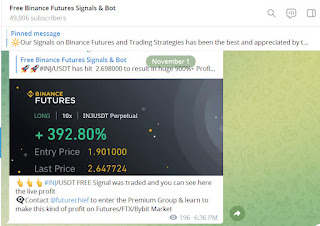

Visit - https://t.me/binancefuturesignal

Free Binance future, Bybit, BitSeven, Coinpro, bitMEX Signals on Telegram & Binance future, Bybit BOT copied all Signals Via Cornix BOT in Account

How to invest in Litecoin: is it a good investment?

Litecoin is a well established cryptocurrency that has managed to bring good returns to those who invested in it at the right time. Should we invest in Litecoin now? Should I invest in bitcoin or litecoin? How to invest in litecoin? If you are asking yourself these questions, this article is for you.

What is Litecoin (LTC)?

Litecoin is a decentralized cryptocurrency, similar to bitcoin but with faster transaction confirmation times. In the cryptocurrency community, it was often referred to as "digital money" until ethereum assumed that title. Litecoin was created by Google employee Charles Lee and launched on October 13, 2011 as an alternative to bitcoin for everyday use. One of the main differences between Litecoin and Bitcoin is the increase in the speed of block formation and therefore transactions (2.5 minutes versus 10 minutes for Bitcoin). Also, Litecoin's transaction fees are lower. Litecoin currently ranks eighth by market cap among all cryptocurrencies.

Is it worth investing in Litecoin?

Although Litecoin has been significantly overtaken by competing cryptocurrencies in recent years, it remains a fairly common and popular cryptocurrency. It trades on many cryptocurrency trading platforms and has a fairly good level of adoption compared to many other cryptocurrencies. This allows us to say that Litecoin still has potential as an investment asset and that its investment is worthwhile.

However, it should be remembered that cryptocurrencies are not only very profitable, they can also be high risk investments. This fact should always be taken into account in investment decisions, including investments in LTC

Invest in Litecoin

When investing in Litecoin, be aware of a very important fact: Unlike investing in stocks or bonds, the only income a cryptocurrency investor receives is from the increase in the price of the cryptocurrency. As such, there is no compound interest in investing in cryptocurrencies. However, given the volatility of the price of cryptocurrencies, the price variation alone can be relatively large.

Litecoin investment fund

One of the investment methods of Litecoin is participation in what is called a Litecoin investment fund. A Litecoin investment fund looks like a normal fund, but Litecoin is the only asset. When investing in a fund, an investor does not buy the litecoins themselves, but a stake in the fund.

Litecoin Fund9c14ccd336df38de002aa1771667a124171fa3144c28f6a3dc64f6d005dc7dad.jpeg

Although Litecoin mutual funds allow investors to benefit from the price movement of LTC without having to buy and store Litecoin themselves, it remains an intermediary whose services come at a cost. Also, as already mentioned, the investor does not own the litecoins themselves, only their derivatives. This is why we recommend that you buy and store Litecoins on your own.

Is Litecoin a Good Long Term Investment?

When considering litecoin as a long-term investment, it is helpful to look at its fundamental qualities as a cryptocurrency and as a project in general.

The following facts support litecoin:

Its longevity. Litecoin is one of the most established cryptocurrencies. As such, it is less risky to invest in Litecoin than in newer cryptocurrencies.

There is an active developer working on it.

Litecoin is a cryptocurrency with fast transactions and very low transaction fees.

It serves as a complementary coin to bitcoin, “digital gold”.

Litecoin is widely adopted and traded on virtually all cryptocurrency exchanges.

But there are also some criticisms of litecoin. It is claimed that it has no real advantages over its competitors and therefore lacks potential. Furthermore, its outlook is vague.

Anyway, it should be noted that

with a long term investment, the investor loses the opportunity to make money on short term price fluctuations which can be very large. A compromise strategy, in this case, may be to trade litecoins and accumulate the profits from it.

Investing in bitcoin against litecoin

As bitcoin's little brother, litecoin revives when bitcoin consolidates after a price rise, as traders use the profits generated by bitcoin to diversify into other altcoins.

If you are investing in cryptocurrencies, the conservative part of the investment portfolio should be holding bitcoin. It is not contradictory to invest in litecoin and bitcoin at the same time. The main question is how much of your portfolio you want to build up with riskier assets like Litecoin.

Should I invest in Litecoin or Ethereum?

Litecoin and ethereum both have strong support in the cryptocurrency community and both have developers who continue to improve them. Both cryptocurrencies are widely adopted and popular. But what are the differences?

While litecoin is intended to be a faster and cheaper version of bitcoin for everyday use, Ethereum is a platform for the development of decentralized applications. This means that Ethereum has broader uses, while Litecoin is nothing more than a cryptocurrency.

Maximum offer. Litecoin's supply is limited: there will be no more than 84 million coins. Ethereum's supply, on the other hand, is unlimited. This fact will constitute a natural constraint to price growth.

Transaction fees. Currently, the average transaction fee for ethereum is $ 1.87, which is pretty steep. Litecoin's average transaction fees are much lower, at just $ 0.0159. This means that litecoin transactions are much cheaper.

Speed of the transaction. While litecoin confirms transactions every 2.5 minutes, ethereum does so every 15 seconds, making it one of the fastest cryptocurrencies.

Litecoin Average Transaction Fee Chart

So should you invest in Litecoin or Ethereum? It's up to you, but we recommend that you diversify your portfolio between the two.

How to invest in LTC?

To invest in Litecoin, you must buy it. You also need a digital wallet to store it.

Where can I invest in Litecoin?

There are many places where you can invest in Litecoin. One of the easiest ways is to simply create an account on a cryptocurrency exchange, make a deposit, and buy LTC. You can then transfer your Litecoins to a cryptocurrency wallet or leave them on the exchange and use them for trading. In addition, you can buy Litecoins on online exchange platforms or from someone you trust. Another way to invest in Litecoin is to purchase an LTC cloud mining contract through a reliable cloud mining service.

One of the best possible places to invest in litecoin is StormGain. Not only is it a convenient way to purchase LTC and a safe place to store it, StormGain also offers a loyalty program with an annual interest rate of up to 12%. Additionally, StormGain has its own all-in-one cryptocurrency mobile app which can be used to invest in Litecoin, among other things.

StormGain cryptocurrency mobile application

How much should I invest in Litecoin?

Because LTC, like other cryptocurrencies, is a high-risk, high-profit investment, the first rule of investing is "never invest more than you can afford to lose." Do not invest more money in Litecoin than you need to survive.

While keeping this in mind, it should be mentioned that StormGain's loyalty program offers bonuses and interest on deposits starting at USDT 500.

Who invested in litecoin?

Although not many people openly talk about their investments, we do know of some celebrities who have invested in Litecoin. Famous Icelandic singer Bjork invited her fans to buy her albums with various cryptocurrencies, including litecoin. NFL cornerback Richard Sherman said he invested money in litecoin.

It's also worth noting that although we don't know their owners, there are currently 283 Litecoin addresses with over $ 1 million in Litecoin each. 63 other addresses have over $ 10 million

Comments

Post a Comment