#Grayscale Splits Ethereum Stock Worth $1.6 Billion, Making It Cheaper to Buy

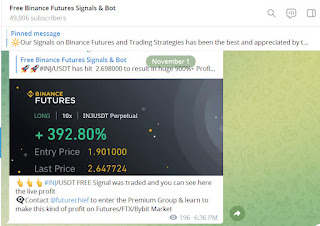

Visit - https://t.me/binancefuturesignal

Free Binance future, Bybit, BitSeven, Coinpro, bitMEX Signals on Telegram & Binance future, Bybit BOT copied all Signals Via Cornix BOT in Account

Grayscale, a crypto investment fund, is splitting its stock. This makes it more accessible to the masses.

In brief

Grayscale is slashing shares in the Grayscale Ethereum Trust into nine pieces.

This will make individual shares in the trust cheaper.

It won't affect the total value of the fund.

Grayscale Investments today announced that it is splitting the stock of its Grayscale Ethereum Trust, likely to make it more affordable to retail investors priced out by the cryptocurrency market's boom.

On December 14, Grayscale will split the shares of the Trust, which holds $1.6 billion assets under management, by 9 to 1. Anyone who currently owns shares in Grayscale will receive 8 extra shares.

The Grayscale Ethereum Trust is the closest thing to a Bitcoin Exchange-Traded Fund. The fund, which is listed on the stock market, represents shares in a pool of private investors’ money, which Grayscale had used to buy Ethereum, the second-largest cryptocurrency by market cap.

But the share price of the Grayscale Ethereum Trust, which loosely represents a fraction of the price of Ethereum (plus a hefty premium, the result of Grayscale’s management fees), has risen this year, from $60 per share to its current price, $109.

There appear to be two reasons for the rise:

First, the price of Ethereum has risen from about $340 at the start of October to highs of $635, according to data from CoinMarketCap. Second, Grayscale has bought a whole lot of Ethereum this year, meaning that there’s more ETH to each share.

So, if the price of ETH keeps rising, smaller fish (known as retail investors) might be unable to afford an investment in the fund. will collapse the price of each share but makes no difference to the overall value of the fund.

Grayscale has split stocks before. In January 2018, as Bitcoin was on its downward crash (who knew back then?). Grayscale split its stock by 91 to 1, meaning that investors would receive an extra 90 shares. Then, Grayscale’s fund was worth $3.19 billion. Now, it has a market cap of $12.8 billion.

Comments

Post a Comment