##Ripple co-founder warns the US could lose a "tech cold war" with China

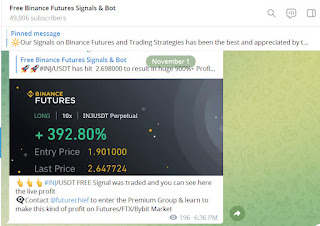

Free Crypto Signals Mobile App -

https://play.google.com/store/apps/details?id=com.freecryptosignals.app

Visit - https://cryptobotauto.com

For more latest news update on Cryptocurrency, Free Bitcoin Binance auto trading BOT & Crypto signals for Binance, BitMEX, ByBit Bittrex visit above given website

China’s dominance in blockchain and financial technology could oust the US-led global financial system, according to Larsen.

In brief

Ripple founder Chris Larsen claims that China and the US are in a "technological cold war"

China has near-ubiquitous use of digital payments, and an upcoming digital yuan which could threaten the US-led financial system.

Larsen also argues that China's control of cryptocurrency hashing power could enable it to meddle with transactions.

Chris Larsen, co-founder and executive chairman of blockchain-powered remittance network Ripple, has authored an op-ed claiming that the United States and China are already embroiled in a "technological cold war".

According to Larsen, China’s dominance in cryptocurrency and finance could be a major front in future battles between the two countries.

Larsen argued that the US dollar’s hegemony over global financial systems might lose out in the face of technological advancements in cryptocurrencies and the use of digital wallets, blockchain technology, and interoperability protocols.

That, he suggests, creates an opportunity for China to leapfrog over traditional dollar-led financial systems through its use of mobile payments including its digital currency electronic payment (DCEP) system—the state-controlled electronic yuan designed to help internationalize the currency.

“For China, this is a once-in-a-century opportunity to wrest away American stewardship of the global financial system, including its ultimate goal of replacing the dollar with a digital yuan,” Larsen wrote.

As reported by Decrypt media partner Forkast.News, China’s ubiquitous mobile payment systems have already become part of ordinary life, with most citizens using Alipay and WeChat Pay, created by tech giants Alibaba and Tencent. Mobile payments reached 277.4 trillion yuan ($39.07 trillion) in 2018—more than 28 times that of 2014.

Could China reverse crypto transactions?

At least 65% of cryptocurrency mining occurs in China, according to the University of Cambridge Centre for Alternative Finance. According to Larsen, the US losing its financial hegemony could also become a threat to cryptocurrencies, as China could leverage the accumulation of hashing power within its jurisdiction to meddle with transactions.

“It's not hard to imagine a dystopian future,” wrote Larsen. “A US defense payment to an ally could be blocked or reversed. A US company’s payments to a Vietnamese manufacturer could be stalled. US banks could have their payments restricted if they run afoul of Chinese policy goals.”

China’s DCEP vs the US digital dollar

Trials of the DCEP are currently underway in several cities in China, and analysts believe that its official launch could rival the impact that Sputnik had on relations between the US and China.

China’s Belt and Road Initiative is another long-term strategy employed by China to bolster its international economic clout, in essence becoming a new “Silk Road” to participant countries. The Belt and Road could become an important conduit for the DCEP to replace the US dollar in cross-border transactions and international finance if it is accepted by China’s trading partner

Comments

Post a Comment