#U.S. Government Releases Roadmap To Mitigate Crypto Risk For Investors

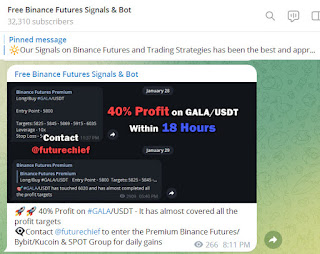

Binance Future Signals - https://binancefuturessignals.com/

Binance Future Signals - https://telegram.me/binancefuturesignal

Free Bitcoin Signals App -

https://play.google.com/store/apps/details?id=com.signalBroadcaster.FreeBitcoinSignals

We are the Number# 1 Community on Telegram in 2023 provide high end tools and high quality Signals Crypto signals with an around 80-90% accuracy. All signals are provided by our Experts Team with proper take profit and proper stop loss including leverage for making daily profit in your account & Signals are informed to Elite Members very early in advance thus any trader from any part of the World can easily take position

We also provide Binance Futures, Bybit, Bitfinex, Kucoin, WazirX, Coinswitch, CoinDCX auto trading Bot. This Bot follows the auto Signals and trades as per take profit and stop loss automatically. The Bot also has a special feature of making spontaneous trades, these are the trades which are made by the Bot according to the Trend of the market. It is all automatic without any manual intervention

The U.S. government is set to tighten regulations to mitigate the growing risks associated with the crypto industry. This development comes after increased scrutiny following the collapse of FTX and Terra Luna in 2022.

In a press release on January 27, the White House put forward a comprehensive roadmap designed to protect investors and hold bad actors accountable. The roadmap highlighted several measures for more effective regulations in the crypto industry.

A Two-Pronged Approach By U.S. Government

The U.S. government revealed that it had spent the past two years identifying the risks of cryptocurrency and finding ways to mitigate them. To ensure these measures are implemented, the White House intends to utilize a two-pronged approach.

Firstly, the U.S. government has developed a framework for individuals and organizations to safely and responsibly develop digital assets. This includes addressing the risks they pose as well as highlighting poor practices within the crypto industry.

Secondly, agencies have been mandated to increase enforcement and develop new regulations where needed. While there’s an increase in public awareness programs designed to help consumers understand the risks of buying cryptocurrencies.

The White House also pointed out that Congress had a major role in expanding regulators’ powers and passing transparency laws for cryptocurrency companies. It also warned about passing legislation that would reverse the current gains and tie cryptocurrency with the U.S. financial system.

In addition, the government intends to commit significant resources toward digital assets research and development, and this would help technologies power digital currencies and protect investors by default.

Crypto Industry Still Reeling From FTX Collapse

The crypto industry is still recovering from the bearish markets resulting from several CeFi platforms’ high-profile collapses. 3AC, Voyager, BlockFi, and FTX were among the top platforms to file for bankruptcy, with the quartet holding more than $100 billion in assets.

The nature of FTX collapse brought about increased scrutiny of the crypto industry. Congress testimonials exposed the risk-averse nature of crypto companies’ executives as details emerged that Sam Bankman-Fried misused clients’ funds through his trading firm Alameda Research.

The ripple effect was massive as several individuals and firms exposed to the platform suffered huge losses, with some companies forced to shut down. These events caused concerns and reactions from within and outside the crypto space. It is, therefore, unsurprising that the U.S. government is looking to tighten its grip on regulations.

Months after the FTX crash, there’s still increased skepticism about the crypto industry. There’s an increase in the amount of bitcoin withdrawn from exchanges, and earlier this month crypto bank, Silvergate revealed that clients withdrew almost $8 billion of their crypto deposits.

Comments

Post a Comment